Insights

Insights

legal updates

20 / 03 / 24

Russian courts continue to consider disputes related to sanctions restrictions imposed by foreign states. In March 2024, further rulings were adopted which developed the existing practice of applying the provisions of article 248.1 of the Arbitrazh Procedure Code of the Russian Federation (exclusive jurisdiction of Russian courts), article 248.2 of the Arbitrazh Procedure Code of the Russian Federation (anti-suit injunction) and article 401 of the Civil Code of the Russian Federation (force majeure) in connection with the imposition of sanctions. Read further in our legal update.

press releases

13 / 03 / 24

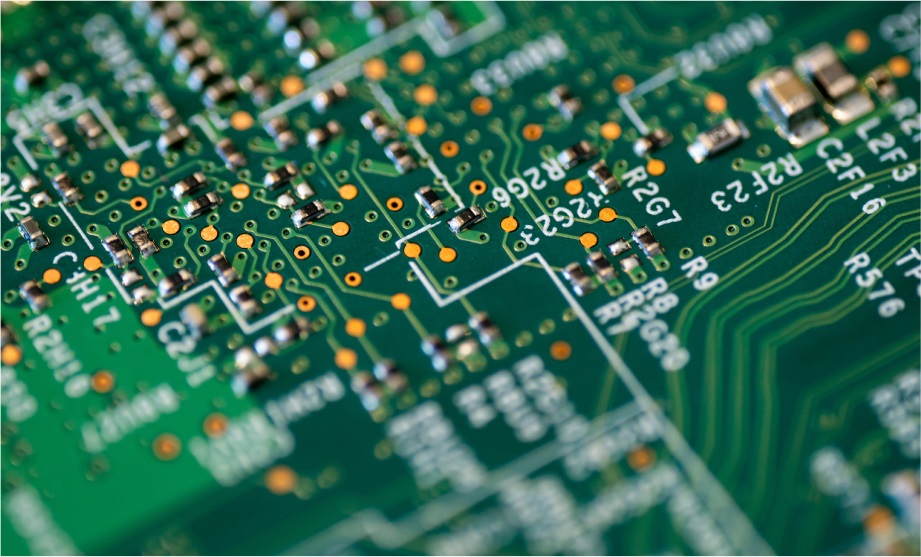

Thanks to the deal, Yandex is purchasing not only a technology platform, but an experienced team of eLama’s professionals who will contribute to the further development of the platform service.

legal updates

05 / 03 / 24

In early September 2023, the Law on so-called “economically significant organisations” entered into force, which makes it possible to suspend, via a court procedure, the corporate rights of foreign holding companies in relation to ESOs and also offers an opportunity for ESOs’ beneficial owners to take direct ownership of the shares/participation interest in ESOs. Until recently, there was no list of ESOs approved by the Russian Government. However, on 4 March 2024, the Russian Government published the first version of such list which includes six Russian companies. For more details on the contents of such list and its consequences for ESOs, please read our latest legal update.

press releases

28 / 02 / 24

Denuo has advised Samolet, one of the largest proptech and real estate development corporations in Russia, on the acquisition of Russian commercial bank Sistema from a private owner. The bank had over RUB1 billion in equity capital at the time of its acquisition.

events

15 / 0310:30 msk

Disclosure of information on corporate agreements: legislative regulation and current issues

legal updates

26 / 02 / 24

On 23 February 2024, the EU published new regulations formalising the 13th package of restrictive measures (sanctions) of the European Union.

legal updates

26 / 02 / 24

On 23 February 2024, the US President announced a record number of sanctions against Russia, over 500 new restrictions on Russian and foreign persons. The new sanctions restrictions are for the most part made of blocking sanctions. The US Department of the Treasury’s Office of Foreign Assets Control has published an updated specially designated nationals list.

legal updates

26 / 02 / 24

On 22 February 2024, the UK announced new blocking sanctions that affected 50 Russian and non-Russian individuals and businesses linked to the Russian defence industry, metals industry, the manufacture and supply of electronics, diamonds, energy trade, etc.

legal updates

13 / 02 / 24

In late 2022, the Supreme Court of the Russian Federation set aside two court rulings in favour of importers regarding the inclusion of licence fees (royalties) in the customs value of imported goods.

In the course of the retrial of the cases, the lower courts ruled in favour of the customs authority and upheld the decisions that royalties shall be included in the customs value. Such approach has become commonly applied to other cases. However, despite the negative practice for importers, in a number of cases participants of foreign economic activity have been able to defend the position that royalties should not be included in the customs value of imported goods. Read further in our legal update.

In the course of the retrial of the cases, the lower courts ruled in favour of the customs authority and upheld the decisions that royalties shall be included in the customs value. Such approach has become commonly applied to other cases. However, despite the negative practice for importers, in a number of cases participants of foreign economic activity have been able to defend the position that royalties should not be included in the customs value of imported goods. Read further in our legal update.

legal updates

12 / 02 / 24

In the venture capital industry, there is a popular saying that the main things to worry about in venture capital deals are money and control. Whereas money implies issues concerning the valuation of a company and the amount of investment, the issue of control is mainly resolved through the appropriate formation of a board of directors. In this issue, we discuss the principles underlying the negotiation of the best model of the board of directors in technology companies.

Subscribe to our updates